Reloading Russia’s railways

In just five years, United Wagon Company has used new designs, new technologies and a comprehensive, vertically integrated approach to become a leading manufacturer of a new-generation freight wagons in the Commonwealth of Independent States.

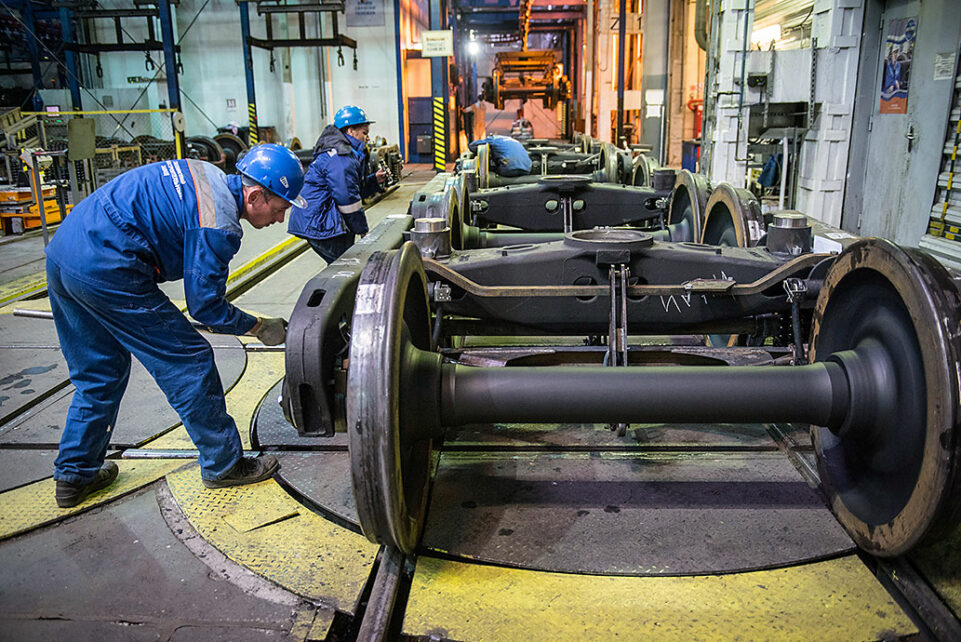

This is precisely what United Wagon Company (UWC) set out to do when it was founded in 2012. The company invested some 1.4 billion euros in a new state-of-the-art manufacturing centre in the town of Tikhvin, some 200 kilometres east of St Petersburg, and began producing a new generation of freight wagons using a Barber bogie design developed in partnership with the US-based Wabtec Corp.

We have highly educated personnel, high-quality components and a comprehensive quality-control system. All of that enables us to set a very high standard.

Igor Korotkov

chief production engineer at TVSZ’s mechanical manufacturing department

The new Tikhvin Freight Wagon Building Plant (TVSZ) is highly automated, with 20 production lines equipped with more than 100 robots. “We have a great advantage over our competitors,” says Igor Korotkov, chief production engineer at TVSZ’s mechanical manufacturing department. “Our factory was built and opened very recently, with new equipment that meets all the necessary specifications and certifications.

“We have highly educated personnel, high-quality components and a comprehensive quality-control system,” Korotkov says. “All of that enables us to set a very high standard. We’re tops in terms of both productivity and quality.”

These claims have been backed up with results. In the five years since the plant opened, UWC has captured a market share of more than 40 percent in Russia’s freight wagon supply sector and is scheduled to produce up to 20,000 freight wagons in 2017.

Thanks to design and construction innovations, the new wagons feature a host of benefits. For example, the new wagons will require servicing only every 800,000 kilometres, compared with every 110,000 kilometres for the previous generation of wagons, and overall running costs will be reduced to one-third of those of older wagons. Similarly, the new wagons can accommodate an axle load of 25 tonnes and over, surpassing the upper limit of 23.5 tonnes for the previous generation.

Meanwhile, even with the heavier loads that the new freight wagons can carry, there is no extra wear and tear on the railway tracks. In fact, UWC and Wabtec have managed to reduce the negative impact on the lines, which resulted in a positive economic effect for Russian Railways, the government company that manages and operates Russia’s railway lines and permanent infrastructure.

The overall approach taken by UWC has been one of vertical integration. Alongside its manufacturing facilities, it has an engineering R&D centre in St Petersburg, a leasing and transport company, the Titran-Express service centre at its Tikhvin plant (see fact box), and NPC Springs in Izhevsk, which has a production capacity of 30,000 wagon-sets of railroad springs per year.

Roman Savushkin, UWC’s CEO, says this approach provides significant advantages over competitors, given the cyclical nature of the industry, which was hit hard by the financial collapse of 2008. “The company’s business model ensures stability and effective cooperation between our subsidiaries at all stages of value creation, from design to distribution of the product,” Savushkin says.

At present, the prospects for that market are looking good. According to industry analysts, some 300,000 freight wagons (30 percent of those currently operated on the Russian railways) are the potential demand by 2022. With production across the country at about 40,000 wagons a year, UWC appears to be excellently placed to play its market maker part in the much-needed renewal of Russia’s rolling stock.